State Issues

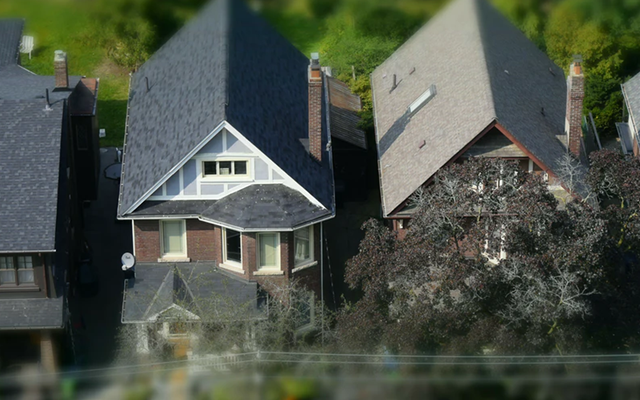

State Constitutional Amendment Proposes a Cap on the Assessed Value of Homesteaded Properties

October 2, 2024

This November, voters across the country will go to the polls to support their favorite candidate for president and other local, state, and federal candidates. In Georgia, voters will also have the opportunity to vote for a constitutional amendment that would “limit increases in the assessed value of homesteads.”

The Georgia Local Option Homestead Property Tax Exemption Amendment will appear on the 2024 November ballot as a legislatively referred constitutional amendment. A legislative referral amends the state constitution.

This tax initiative passed the Georgia General Assembly earlier this year as House Resolution 1022.

The cap, if passed, would apply to all county governments, consolidated governments, municipalities, or local school systems. However, the legislation provides an exemption for jurisdictions that already have similar caps and requires the legislature to develop an opt-out process for jurisdictions that complete certain procedures.

.tmb-cll.png?sfvrsn=9a627684_1)